| News |

|

| Eric J. Lerner |

| What's wrong with the

electric grid? |

|

The warnings were certainly there. In 1998, former

utility executive John Casazza predicted that “blackout risks will be

increased” if plans for deregulating electric power went ahead. And the

warnings continued to be heard from other energy experts and planners.

So it could not have been a great surprise to the

electric-power industry when, on August 14, a blackout that covered

much of the Northeast United States dramatically confirmed these

warnings. Experts widely agree that such failures of the

power-transmission system are a nearly unavoidable product of a

collision between the physics of the system and the economic rules that

now regulate it. To avoid future incidents, the nation must either

physically transform the system to accommodate the new rules, or change

the rules to better mesh with the power grid’s physical behavior.

Understanding the grid’s

problems starts with its physical behavior. The vast system of

electricity generation, transmission, and distribution that covers the

United States and Canada is essentially a single machine— by many

measures, the world’s biggest machine. This single network is

physically and administratively subdivided into three “interconnects”—

the Eastern, covering the eastern two-thirds of the United States and

Canada; the Western, encompassing most of the rest of the two

countries; and the Electric Reliability Council of Texas (ERCOT),

covering most of Texas (Figure 1). Within each interconnect, power

flows through ac lines, so all generators are tightly synchronized to

the same 60-Hz cycle. The interconnects are joined to each other by dc

links, so the coupling is much looser among the interconnects than

within them. (The capacity of the transmission lines between the

interconnects is also far less than the capacity of the links within

them.) Understanding the grid’s

problems starts with its physical behavior. The vast system of

electricity generation, transmission, and distribution that covers the

United States and Canada is essentially a single machine— by many

measures, the world’s biggest machine. This single network is

physically and administratively subdivided into three “interconnects”—

the Eastern, covering the eastern two-thirds of the United States and

Canada; the Western, encompassing most of the rest of the two

countries; and the Electric Reliability Council of Texas (ERCOT),

covering most of Texas (Figure 1). Within each interconnect, power

flows through ac lines, so all generators are tightly synchronized to

the same 60-Hz cycle. The interconnects are joined to each other by dc

links, so the coupling is much looser among the interconnects than

within them. (The capacity of the transmission lines between the

interconnects is also far less than the capacity of the links within

them.)

|

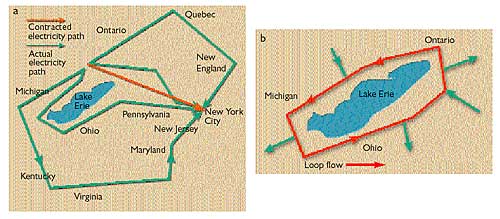

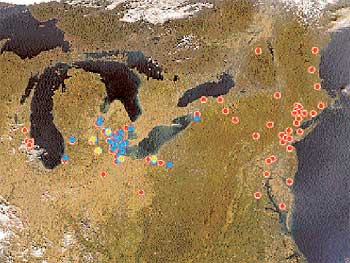

| Figure

2. Electric power does not travel just by the shortest route

from source to sink, but also by parallel flow paths through other

parts of the system (a). Where the network jogs around large

geographical obstacles, such as the Rocky Mountains in the West or the

Great Lakes in the East, loop flows around the obstacle are set up that

can drive as much as 1 GW of power in a circle, taking up transmission

line capacity without delivering power to consumers (b). |

Prior to deregulation, which began in the 1990s,

regional and local electric utilities were regulated, vertical

monopolies. A single company controlled electricity generation,

transmission, and distribution in a given geographical area. Each

utility generally maintained sufficient generation capacity to meet its

customers’ needs, and long-distance energy shipments were usually

reserved for emergencies, such as unexpected generation outages. In

essence, the long-range connections served as insurance against sudden

loss of power. The main exception was the net flows of power out of the

large hydropower generators in Quebec and Ontario.

This limited use of long-distance connections aided

system reliability, because the physical complexities of power

transmission rise rapidly as distance and the complexity of

interconnections grow. Power in an electric network does not travel

along a set path, as coal does, for example. When utility A agrees to

send electricity to utility B, utility A increases the amount of power

generated while utility B decreases production or has an increased

demand. The power then flows from the “source” (A) to the “sink” (B)

along all the paths that can connect them. This means that changes in

generation and transmission at any point in the system will change

loads on generators and transmission lines at every other point—often

in ways not anticipated or easily controlled (Figure 2).

To avoid system failures, the amount of power flowing

over each transmission line must remain below the line’s capacity.

Exceeding capacity generates too much heat in a line, which can cause

the line to sag or break or can create power-supply instability such as

phase and voltage fluctuations. Capacity limits vary, depending on the

length of the line and the transmission voltage (Table 1). Longer lines

have less capacity than shorter ones.

In addition, for an ac power grid to remain stable, the

frequency and phase of all power generation units must remain

synchronous within narrow limits. A generator that drops 2 Hz below 60

Hz will rapidly build up enough heat in its bearings to destroy itself.

So circuit breakers trip a generator out of the system when the

frequency varies too much. But much smaller frequency changes can

indicate instability in the grid. In the Eastern Interconnect, a 30-mHz

drop in frequency reduces power delivered by 1 GW.

If certain parts of the grid are carrying electricity at

near capacity, a small shift of power flows can trip circuit breakers,

which sends larger flows onto neighboring lines to start a

chain-reaction failure. This happened on Nov. 10, 1965, when an

incorrectly set circuit breaker tripped and set off a blackout that

blanketed nearly the same area as the one in August.

After the 1965 blackout, the industry set up regional

reliability councils, coordinated by the North American Electric

Reliability Council, to set standards to improve planning and

cooperation among the utilities. A single-contingency-loss standard was

set up to keep the system functioning if a single unit, such as a

generator or transition line, went out. Utilities built up spare

generation and transmission capacity to maintain a safety margin.

In 1992, the economic rules governing the grid began to

change with passage of the Energy Policy Act. This law empowered the

Federal Energy Regulatory Commission (FERC) to separate electric power

generation from transmission and distribution. Power deregulation—in

reality, a change in regulations—went slowly at first. Not until 1998

were utilities, beginning in California, compelled to sell off their

generating capacity to independent power producers, such as Enron and

Dynergy.

|

| Table

2. Prior to the implementation of Federal Energy Regulatory

Commission Order 888, which greatly expanded electricity trading, the

cost of electricity, excluding fuel costs, was gradually falling.

However, after Order 888, and some retail deregulation, prices

increased by about 10%, costing consumers $20 billion a year. |

The new regulations envisioned trading electricity like

a commodity. Generating companies would sell their power for the best

price they could get, and utilities would buy at the lowest price

possible. For this concept to work, it was imperative to compel

utilities that owned transmission lines to carry power from other

companies’ generators in the same way as they carried their own, even

if the power went to a third party. FERC’s Order 888 mandated the

wheeling of electric power across utility lines in 1996. But that order

remained in litigation until March 4, 2000, when the U.S. Supreme Court

validated it and it went into force.

In the four years between the issuance of Order 888 and

its full implementation, engineers began to warn that the new rules

ignored the physics of the grid. The new policies “ do not recognize

the single-machine characteristics of the electric-power network,”

Casazza wrote in 1998. “The new rule balkanized control over the single

machine,” he explains. “It is like having every player in an orchestra

use their own tunes.”

In the view of Casazza and many other experts, the key

error in the new rules was to view electricity as a commodity rather

than as an essential service. Commodities can be shipped from point A

through line B to point C, but power shifts affect the entire

singlemachine system. As a result, increased longdistance trading of

electric power would create dangerous levels of congestion on

transmission lines where controllers did not expect them and could not

deal with them.

The problems would be compounded, engineers warned, as

independent power producers added new generating units at essentially

random locations determined by low labor costs, lax local regulations,

or tax incentives. If generators were added far from the main consuming

areas, the total quantity of power flows would rapidly increase,

overloading transmission lines. “ The system was never designed to

handle long-distance wheeling,” notes Loren Toole, a

transmission-system analyst at Los Alamos National Laboratory.

At the same time, data needed to predict and react to

system stress—such as basic information on the quantity of energy

flows—began disappearing, treated by utilities as competitive

information and kept secret. “Starting in 1998, the utilities stopped

reporting on blackout statistics as well,” says Ben Carreras of Oak

Ridge National Laboratory, so system reliability could no longer be

accurately assessed.

Finally, the separation into generation and transmission

companies resulted in an inadequate amount of reactive power, which is

current 90 deg out of phase with the voltage. Reactive power is needed

to maintain voltage, and longer-distance transmission increases the

need for it. However, only generating companies can produce reactive

power, and with the new rules, they do not benefit from it. In fact,

reactive-power production reduces the amount of deliverable power

produced. So transmission companies, under the new rules, cannot

require generating companies to produce enough reactive power to

stabilize voltages and increase system stability.

The net result of the new rules was to more tightly

couple the system physically and stress it closer to capacity, and at

the same time, make control more diffuse and less coordinated—a

prescription, engineers warned, for blackouts.

In March 2000, the warnings began to come true. Within a

month of the Supreme Court decision implementing Order 888, electricity

trading skyrocketed, as did stresses on the grid (Figure 3). One

measure of stress is the number of transmission loading relief

procedures (TLRs)—events that include relieving line loads by shifting

power to other lines. In May 2000, TLRs on the Eastern Interconnect

jumped to 6 times the level of May 1999. Equally important, the

frequency stability of the grid rapidly deteriorated, with average

hourly frequency deviations from 60 Hz leaping from 1.3 mHz in May

1999, to 4.9 mHz in May 2000, to 7.6 mHz by January 2001. As predicted,

the new trading had the effect of overstressing and destabilizing the

grid.

“Under the new system, the financial incentive was to

run things up to the limit of capacity,” explains Carreras. In fact,

energy companies did more: they gamed the system. Federal

investigations later showed that employees of Enron and other energy

traders “knowingly and intentionally” filed transmission schedules

designed to block competitors’ access to the grid and to drive up

prices by creating artificial shortages. In California, this behavior

resulted in widespread blackouts, the doubling and tripling of retail

rates, and eventual costs to ratepayers and taxpayers of more than $30

billion. In the more tightly regulated Eastern Interconnect, retail

prices rose less dramatically.

After a pause following Enron’s collapse in 2001 and a

fall in electricity demand (partly due to recession and partly to

weather), energy trading resumed its frenzy in 2002 and 2003. Although

power generation in 2003 has increased only 3% above that in 2000,

generation by independent power producers, a rough measure of wholesale

trading, has doubled. System stress, as measured by TLRs and frequency

instability, has soared, and with it, warnings by FERC and other

groups.

|

|

Figure 3. After

wholesale electricity trading began in earnest following Federal Energy

Regulatory Commission’s Order 888, stress on the transmission grid

jumped and continued to climb, as shown by the transmission loading

relief procedures (a) and the monthly average frequency errors (b).

|

Major bank and investment institutions such as Morgan

Stanley and Citigroup stepped into the place of fallen traders such as

Enron and began buying up power plants. But as more players have

entered and trading margins have narrowed, more trades are needed to

pay off the huge debts incurred in buying and building generators.

Revenues also have shrunk, because after the California debacle, states

have refused to substantially increase the rates consumers pay. As

their credit ratings and stock prices fell, utility companies began to

cut personnel, training, maintenance, and research. Nationwide, 150,000

utility jobs evaporated. “We have a lot of utilities in deep financial

trouble,” says Richard Bush, editor of Transmission and

Distribution, a trade magazine.

The August 14 blackout, although set off by specific

chance events, became the logical outcome of these trends (Figure 4).

Controllers in Ohio, where the blackout started, were overextended,

lacked vital data, and failed to act appropriately on outages that

occurred more than an hour before the blackout. When energy shifted

from one transmission line to another, overheating caused lines to sag

into a tree. The snowballing cascade of shunted power that rippled

across the Northeast in seconds would not have happened had the grid

not been operating so near to its transmission capacity.

How to fix it

The conditions that caused the August 14th blackout remain in place. In

fact, the number of TLRs and the extent of frequency instability

remained high after August 14 until September’s cool weather reduced

stress on the grid. What can be done to prevent a repetition next

summer?

One widely supported answer is to change the grid

physically to accommodate the new trading patterns, mainly by expanding

transmission capacity. The DOE and FERC, as well as organizations

supported by the utilities, such as the Electric Power Research

Institute and the Edison Electric Institute, advocate this approach. In

reports before and after the blackout, they urged expanding

transmission lines and easing environmental rules that limit their

construction. The logic is simple: if increased energy trading causes

congestion and, thus, unreliability, expand capacity so controllers can

switch energy from line to line without overloading.

|

|

Figure 4.

Blackout sequence of events, August 14, 2003

1:58 p.m. The Eastlake,

Ohio, generating plant shuts down. The plant is owned by First Energy,

a company that had experienced extensive recent maintenance problems,

including a major nuclear-plant incident.

3:06 p.m. A First Energy 345-kV

transmission line fails south of Cleveland, Ohio.

3:17 p.m. Voltage dips

temporarily on the Ohio portion of the grid. Controllers take no

action, but power shifted by the first failure onto another power line

causes it to sag into a tree at 3:32 p.m., bringing it offline as well.

While Mid West ISO and First Energy controllers try to understand the

failures, they fail to inform system controllers in nearby states.

3:41 and 3:46 p.m. Two breakers

connecting First Energy’s grid with American Electric Power are

tripped.

4:05 p.m. A sustained power

surge on some Ohio lines signals more trouble building.

4:09:02 p.m. Voltage sags

deeply as Ohio draws 2 GW of power from Michigan.

4:10:34 p.m. Many transmission

lines trip out, first in Michigan and then in Ohio, blocking the

eastward flow of power. Generators go down, creating a huge power

deficit. In seconds, power surges out of the East, tripping East coast

generators to protect them, and the blackout is on.

(Orbital Imaging Corp;

processing by NASA Goddard Space Flight Center)

|

To pay the extensive costs, the utilities and the DOE

advocate increases in utility rates. “The people who benefit from the

system have to be part of the solution here,” Energy Secretary Spencer

Abrams said during a television interview. “That means the ratepayers

are going to have to contribute.” The costs involved would certainly be

in the tens of billions of dollars. Thus, deregulation would result in

large cost increases to consumers, not the savings once promised (Table

2).

But experts outside the utility industry point to

serious drawbacks in the build-more solution other than increasing the

cost of power. For one, it is almost impossible to say what level of

capacity will accommodate the long-distance wholesale trading. The data

needed to judge that is now proprietary and unavailable in detail. Even

if made available to planners, this data refers only to the present.

Transmission lines take years to build, but energy flows can expand

rapidly to fill new capacity, as demonstrated by the jump in trading in

the spring of 2000. New lines could be filled by new trades as fast as

they go up.

The solution advocated by deregulation critics would

revise the rules to put them back into accord with the grid physics. “

The system is not outdated, it is just misused,” says Casazza. “We

should look hard at the new rules, see what is good for the system as a

whole, and throw out the rest.” Some changes could be made before next

summer, and at no cost to ratepayers. For one thing, FERC or Congress

could rescind Order 888 and reduce the long-distance energy flows that

stress the system. Second, the data on energy flows and blackouts could

again be made public so that planners would know what power flows are

occurring and the reliability records of the utilities. Other changes,

such as rehiring thousands of workers to upgrade maintenance, would

take longer and might require rewriting regulations and undoing more of

the 1992 Energy Act.

These changes also would have costs, but they would be

borne by the shareholders and creditors of the banks and energy

companies who bet so heavily on energy trading. With cash flows

dwindling and debt levels high, many of these companies or their

subsidiaries might face bankruptcy if energy trading is curtailed. The

decision will ultimately fall to Congress, where hearings are scheduled

for the fall. However the decision turns out, what is nearly certain is

that until fixed, the disconnect between the grid’s economics and

physics will cause more blackouts in the future.

Further reading

Casazza, J. A. Blackouts: Is the Risk Increasing? Electrical World

1998, 212 (4), 62–64.

Casazza, J. A.; Delea, F. Understanding Electric Power Systems: An

Overview of the Technology and the Marketplace; Wiley: New York,

2003; 300 pp.

Hale, D. R. Transmission Data and Analysis: How Loose is the

Connection?; available here.

Loose, V. W.; Dowell, L. J. Economic and Engineering Constraints on the

Restructuring of the Electric Power Industry; available

here.

Mountford, J. D.; Austria, R. R. Power Technologies Inc. Keeping the

lights on! IEEE Spectrum 1999, 36 (6), 34–39.

National Transmission Grid Study Report; available here.

Tucker, R. J. Facilitating Infrastructure Development: A Critical Role

for Electric Restructuring. Presented at the National Energy Modeling

System/Annual Energy Outlook Conference, Washington, DC, March 10,

2003; available

here.

|